The Fallacy of Equal Pay Day

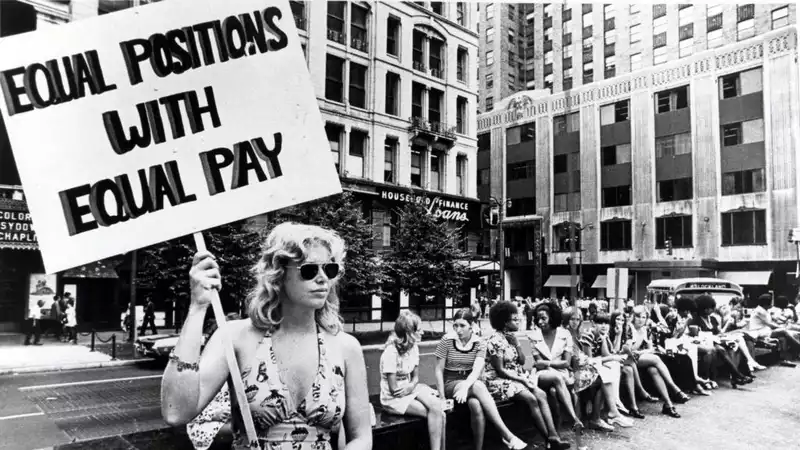

Equal Pay Day is a day that represents how much the "average woman" will have to work in 2021 to earn as much as a white male earned in 2020. It is traditionally a day to lament the gender pay gap, celebrate "successful" women, share research on the positive power of diversity, and offer advice to those who have not yet gotten there on "how to win at work."

However, Equal Pay Day misses the point. In fact, the day misses many points. Let me list a few: First, Equal Pay Day in 2020 was March 31. This year it is March 24. This means that the wage gap between men and women improved during 2020.

Not by a long shot.

In a year when one in five women leave the workplace, women who remain in the workplace are losing productivity, and men are being promoted at three times the rate of women (opens in new tab), it is not clear whether Equal Pay Day should really be in April, June, or October. For black women, whose unemployment rate is 8.4% (opens in new tab) and whose equal pay day is set for August, and for Latino women, whose equal pay day is set for August, it is not clear whether equal pay day should be in April, June, or October. The same is true for Latino women for whom the equal pay date is set in October, even though the unemployment rate for Latinas is over 9% (opens in new tab).

Equal Pay Day has historically been a day for women to shower advice on how to get ahead. How to get ahead, how to be more ambitious, how to be less ambitious, how to know your worth, how to lean in, how to get a raise, how to say "you go girl," how to How can I close the confidence gap? Much has been said about this, but we seem to have no clue. [Because if changing women was the answer, this battle would be over. All our adult lives we have been conforming to society's expectations. So if changing the way we work were the only issue, the financial disparity between men and women would be gone. Instead, women are forced to walk a tightrope of labor, earning less than men.

To add insult to injury, when a child or parent becomes ill and a woman is forced to step down from her work or reduce her working hours to take care of them (opens in new tab), our society tends to assume that this behavior is her "choice." But if the company does not provide sufficient (or any) parental leave, is it a choice to stay home? Or if the parental leave offered by the company is only for her and not for her partner (thereby putting her on the so-called "mommy track" while her spouse is at work, more present and committed to his career).

So.

But my biggest beef with Equal Pay Day is that it focuses on the wrong gender pay gap.

Forgive me for diverting your attention from the wage gap to the wealth gap between men and women. Instead of focusing only on the amount of money women make compared to men (which is important), let's focus on what women have and do have compared to men (which is more important). You may have heard the saying "wealth begets wealth" or "inequality begets inequality". Such forces are at work here, causing women to lose ground in terms of increasing their overall net worth.

The wage gap between men and women has been measured at 82 cents for every dollar of white men (open in new tab), which was moving in the right direction before the pandemic, while the wealth gap between men and women is 32 cents for every dollar of white men (open in new tab). In other words, women's assets are only 32% of white men's. Black and brown women's assets are just one penny (open in new tab) for every dollar of white men's. Even before the pandemic, this statistic was going badly.

There are many reasons why the wealth gap between men and women is much larger than the gender wage gap. For starters, women spend less time working (opens in new tab) (because women often interrupt their careers, which is also not necessarily a true "choice"), women spend more money on children than men (opens in new tab), and of course, women pay the pink tax (opens in new tab open in new tab). But that's not all.

Women bank most of their money (opens in new tab), while men invest most of theirs. In other words, men benefit from the stock market's historical average annual return of 9.8% (open in new tab), while women get almost nothing from their money in the bank (less than zero after inflation). one or two years may not make much difference. But year after year, as the stock market returns compound, the women literally lose a fortune. For some women, this can be hundreds of thousands (or even millions) of dollars over their lifetime.

There is also a "gender debt gap. Women carry more debt than men, with more credit card debt and student loan debt (open in new tab). Women also pay higher interest rates than men on small business and personal loans. In other words, not only are women not enjoying the positive compounding effect of investments, they are also suffering from the negative compounding effect of interest on debt. They have lost money as they have gone back and forth in building their nest egg assets.

Now, before you chalk this up to another "choice" made by women in managing their money, remember that the investment industry is male-dominated: 86% of financial advisors are men (opens in new tab) and 98% of mutual funds are managed by men ( (opens in new tab). You don't have to look far. In fact, even the GameStop trading spree and the giant statue of a sniveling, angry bull near the New York Stock Exchange give some indication of the masculine nature of the industry. No wonder women are leaving in droves. (That's why I founded Elbest (opens in new tab), the first investment and finance company by women, for women.)

The industry is also a masculine one.

We can each do our best by controlling what we can control. Keep asking for raises and promotions, keep taking business risks. But what if there aren't many people like you in your company's C-suite? If you can, you might want to stack the deck a little more in your favor the next time you change jobs. Find out if the company you are about to interview with reports wage disparities between men and women and between races, and if they are working to correct those disparities. Do they offer paid family leave for primary and non-primary caregivers, or require mandatory arbitration agreements for sexual harassment (or worse, do they still operate as if #MeToo never happened)?

You also have control over what you do with the money you earn - use it as strategically as possible to leverage a larger salary into greater wealth (opens in new tab). Pay down debt in the order that saves the most (starting with the highest interest rate), build an emergency fund, contribute to a 401(k) or IRA, and invest to build wealth. None of this is as fun to talk about as when you finally get a raise from your difficult old boss. But taking these financial steps is the number one driver for women to have the confidence (open in new tab) to achieve their financial goals.

Improving your own economic status doesn't mean you can't empower other women: be more intentional about spending and investing your money by buying from and investing in women-led businesses. (Ellevest also has a debit card cash back program (opens in new tab).)

So today, in the midst of the women's recession and with money being the number one cause of stress for women (opens in new tab), on this "Equal Pay Day," let's remember that yes, pay is important, but building nest eggs is more important. Sally Krawcheck is CEO and co-founder of Ellevest (opens in new tab), a financial firm by women for women. She is the former CFO of Citi and former CEO of Merrill Lynch and Smith Barney

.

Comments